Business Meals Deduction 2024

Business Meals Deduction 2024 – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . “These types of use cases for expenses are officially gone.” Businesses can still deduct 50% of the cost of business meals, as long as you or someone from the business are present and the .

Business Meals Deduction 2024

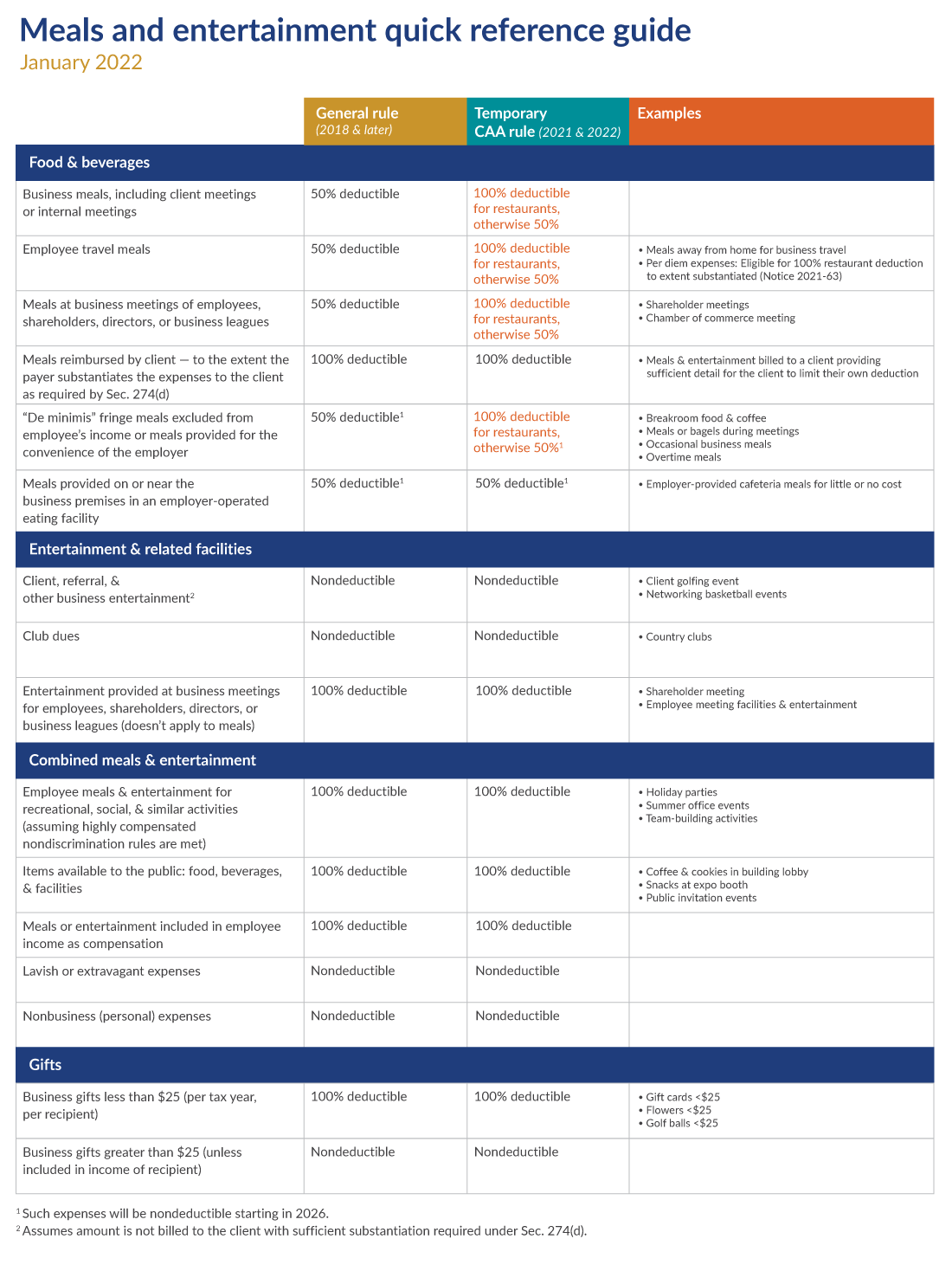

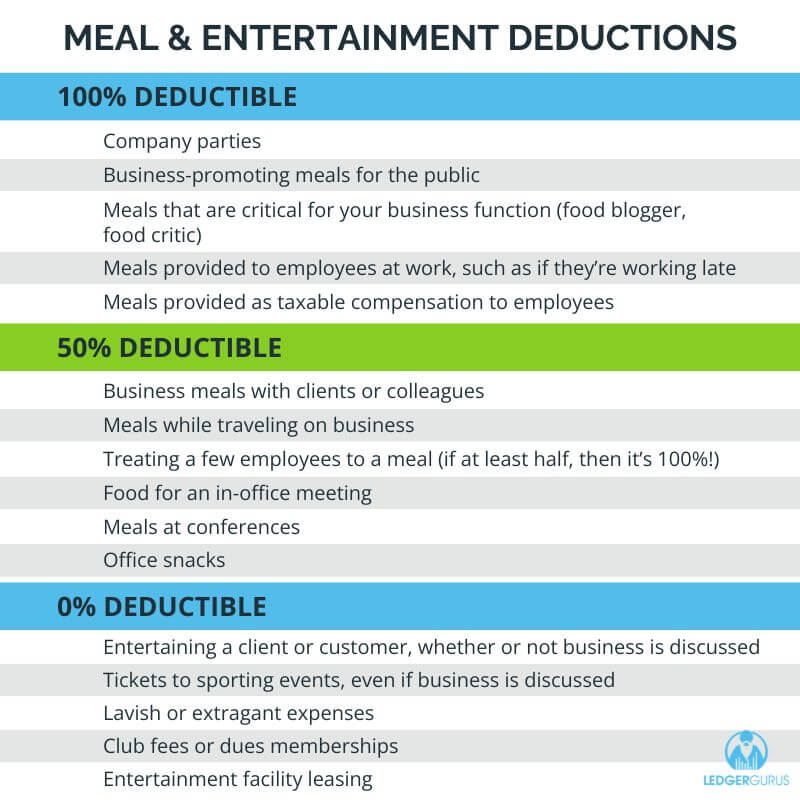

Source : ledgergurus.comCheck, Please: Deductions for Business Meals and Entertainment

Source : www.ellinandtucker.comMeal and Entertainment Deductions for 2023 2024

Source : ledgergurus.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coDeducting Meals as a Business Expense

How to Deduct Business Meals in 2024: Ultimate Guide

Source : www.keepertax.com100% Deduction for Business Meals in 2021 and 2022 Alloy Silverstein

Source : alloysilverstein.comHow to Deduct Business Meals in 2024: Ultimate Guide

Source : www.keepertax.comExpanded meals and entertainment expense rules allow for increased

Source : www.plantemoran.comBusiness Meals Deduction 2024 Meal and Entertainment Deductions for 2023 2024: With new regulations in place, such as the Corporate Transparency Act, in which organizations are required to file an ownership report with the U.S. Department of the Treasury, business owners should . Meals are tax-deductible when they are business-related, such as when attending a business conference or meeting with a client. However, you can’t deduct expenses for your family member or friend .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)

.png)